Cash Management

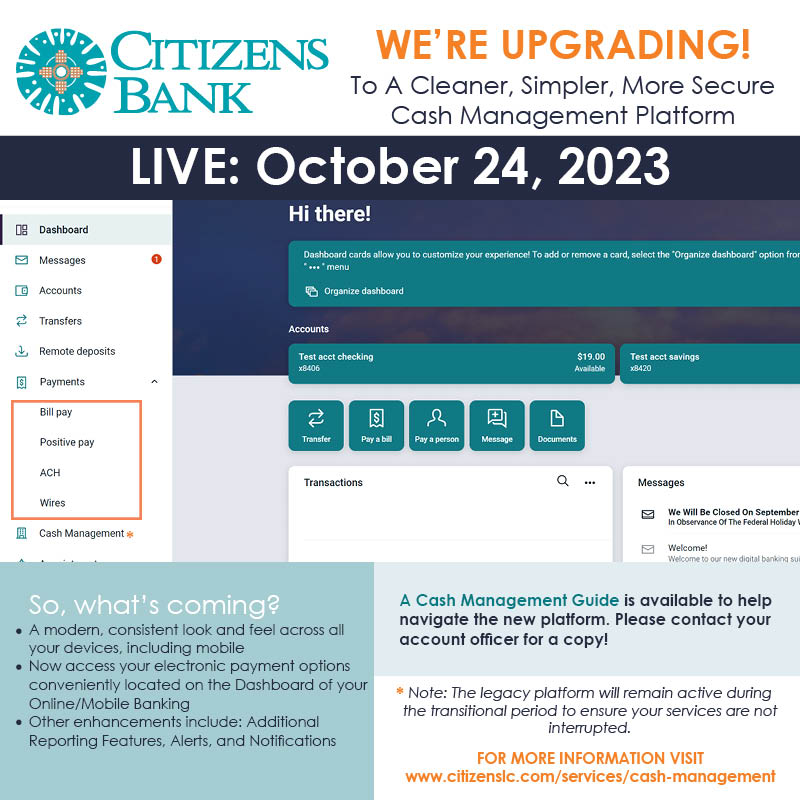

Some important notes regarding the new platform:

- The legacy platform for Cash Management will remain active during the transition phase to ensure your services are not interrupted. Meaning, anything that you do in the new system will show up in the legacy platform, and vice versa.

- All current batch and wire templates will transfer over and be available interchangeably.

- If you are using Business Bill Pay or receive e-statements, please use the legacy platform for these items.

- Contact a Business Banker to receive the Cash Management Guide to help navigate the new platform.

You can access your accounts online at any time to check balances, verify transactions or do reconcilements. This easy access provides you with timely data for forecasting and decision-making. Plus, with this information at your fingertips, you can monitor and control your daily cash position and potentially reduce borrowings.

Account Consolidation

- Review all of your accounts, business and personal

- Review transactions since your last statement as well as all transactions from your previous statement

- Review loan payment history, including interest/principal payments

ACH Origination

This feature allows you to create electronic transactions that the bank will forward into the Federal electronic payments system. The most common type of ACH transaction is Direct Deposit Payroll. Other electronic payments can be arranged for vendors/suppliers who can accept electronic payments.

- Direct deposit for employees

- Pay vendors/suppliers directly

- Collect accounts receivable items quickly

E-Statements

- Receive statements on the first day of the month

- Ability to distribute multiple copies

Secure Browser/Security Token

- Security

- Hacking safeguards

Online Banking

- Anytime/anywhere banking

Online Positive Pay

- Fraud protection

Online Business Bill Pay

- Better bill management

- Record of payments made

- Facilitates electronic payments

Direct Line Wire Transfer (Repetitive Transfers)

Our Online Banking allows you to create one-time or recurring wire transfer instructions.

- One-time setup

- Quicker transfer of funds to recipient

Funds Transfers

Set up one-time transfers between accounts, or create your own schedule of recurring transfers. Transfer funds from checking or savings to make loan payments.

Stop Payments

An easy way to add Stop Payment instructions to your accounts.

Multiple User Access

If you have a staff that regularly needs to access your accounts, you have the ability to assign account access and authority levels for individual staff members.

On-site training provided at no cost.

Quicken / Quickbooks

- Citizens Online Banking allows you to download your transaction information into Quicken / Quickbooks using the WebConnect Feature.

- Click here for the Quicken Support page where you can find answers to common issues.

- Click here for the Quickbooks Support page where you can find answers to common issues.

Intuit, Quicken and QuickBooks are registered trademarks of Intuit, Inc.

For more details, call and speak to a business banker or visit any of our locations.